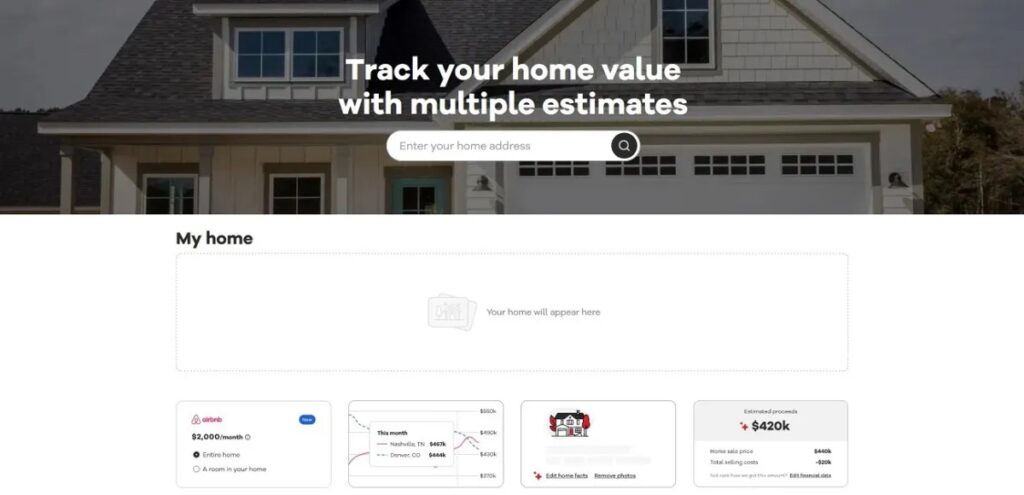

Realtor.com(r)’s “My Home” dashboard gives homeowners an estimate of the potential income from renting out their property.

Nearly 40% of homeowners have or would consider subletting part of their primary home as short-term rental, according to a joint survey from realtor.com(r) and Censuswide – though potential rental income should play an integral part in deciding this step.

Realtor.com(r) recently introduced an estimation tool to assist property owners in estimating their potential earnings from listing their home as a short-term rental. The tool can be found within their “My Home” dashboard on realtor.com(r), using Airbnb data from similar listings within their ZIP code area for seven-day rentals estimates; actual earnings would depend upon local laws, availability, rental price and demand in that particular neighborhood; homeowners can estimate earnings using one room or their entire house as hosts.

Short-term rentals can help offset some of the expenses of homeownership,” states Mausam Bhatt, Chief Product Officer at realtor.com(r). Renting out one’s house during non-peak seasons for several days or weeks could generate extra funds that can go toward mortgage payments, repairs or even cover travel costs for their next vacation!

34 percent of homeowners surveyed by realtor.com(r) and Censuswide reported they’d consider renting their home out to save for future home purchases, while 21% used the extra income towards paying off current mortgages.